Contributor

Well-known member

- Joined

- Jul 9, 2022

- Posts

- 1,423

With normal inflation, the 20K$ then in 1961 will be $183,534.20 in 2022. Houses in CA did better than the inflation rate, as usual. One of the better investments.

Profit in today's money would be $2,482.745.80 in those 61 years. Or gain of $40,700.00 per year average.

See here.

-Don- Reno, NV

While that may be true if you apply the rate of inflation as the returns on the $20k, it is a "not real" comparison unless the buyer payed cash for the house. I prefer to look at it this way.

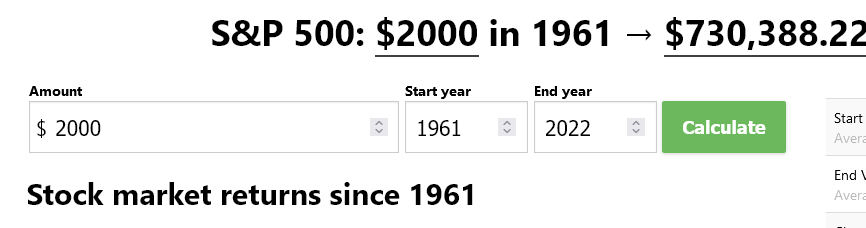

In 1961 a person has $2000 dollars to invest. Two choices are buy a house (20% down with loan at 3.8% interest rate) or invest in the S&P 500 index. Location of house greatly affects the return, not so for the S&P.

So $2k invested in 1961 and left alone would be worth $730,388 today.

That's not bad considering there are no monthly mortgage payments, maintenance cost (roofing, AC, furnace, etc).

When considering the returns on a house investment, one needs to add all of the money spent on interest payment that went to the lender, the money spent on maintenance and the risk that the neighborhood went to pot. The folks in the bay area won on the location but it's a crap shoot for others.