You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

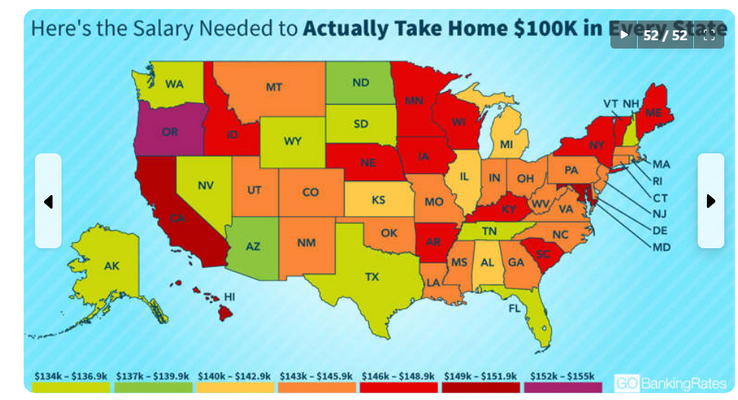

See What It Takes To Take Home $100K in Your State

- Thread starter DonTom

- Start date

The friendliest place on the web for anyone with an RV or an interest in RVing!

If you have answers, please help by responding to the unanswered posts.

If you have answers, please help by responding to the unanswered posts.

John From Detroit

Well-known member

Looks about right at least for Michigan... OUCH the other state I almost settled in was SC (one of the RED states on that map...Of course it could be worse.. I know folks who live in OR

DonTom

Well-known member

The governments always find a way to get your money.I know folks who live in OR

But OR has no sales tax. So everything you buy is cheaper. They should have taken that into consideration with OR.

But if you're a tourist in OR and use the tourist stuff such as motels, they will have a nice high sales tax added.

-Don- Reno, NV

Oldgator73

Well-known member

Delaware doesn’t have a sales tax either.But OR has no sales tax.

Tulecreeper

Well-known member

I'm not totally convinced this is absolutely correct. For the most part, federal tax is the same no matter the state you live in - it's the state tax that gets you. Arkansas's tax system ranks 38th overall on the 2024 State Business Tax Climate Index. And the state income tax rates only range up to 5.9%.

DonTom

Well-known member

And DE is the better deal. In DE, they let you keep 66.89% of your money and takes an income of $149,545.00 to get a real true 100K$.Delaware doesn’t have a sales tax either.

In OR, they only let you keep 63.99% of your money and it takes an income of $156,280.00 to get a real true 100K$.

-Don- Reno, NV

Skookum

Well-known member

- Joined

- Dec 19, 2018

- Posts

- 3,633

No state income tax in WA.

Oldgator73

Well-known member

And $24,000 of my retirement is not taxed (VA disability).And DE is the better deal. In DE, they let you keep 66.89% of your money and takes an income of $149,545.00 to get a real true 100K$.

In OR, they only let you keep 63.99% of your money and it takes an income of $156,280.00 to get a real true 100K$.

-Don- Reno, NV

DonTom

Well-known member

No state income tax in WA.

- Salary needed for $100K: $137,290

- Take home salary: 72.84%

- Salary needed for $100K: $137,290

- Take home salary: 72.84%

-Don- Reno, NV

Oldgator73

Well-known member

We lived in Las Vegas for two years; we’ll take Washington state.NV and WA exactly the same, but you get too much rain up there!

DonTom

Well-known member

I don't understand ex-pats who move to 3rd world countries so they can live like kings. Most could live cheaper in MS which is only a 2nd world country  But seriously, only the far west delta region from Natchez to Memphis gives MS the bad reputation.

But seriously, only the far west delta region from Natchez to Memphis gives MS the bad reputation.

Tulecreeper

Well-known member

None of my Navy pension is taxed here. And the first $12,000 of our CA state pensions is exempt here. That will change when we get to AZ, though. They tax it all as regular income.And $24,000 of my retirement is not taxed (VA disability).

Last edited:

DonTom

Well-known member

What made you decide to leave AR for AZ?None of my Navy pension is taxed here. That will change when we get to AZ, though. They tax as regular income.

Not red-neckish enough for AR?

Go one more state NW and no state income tax.

-Don- Reno, NV

Tulecreeper

Well-known member

My wife's son and his family live there. I figured if we are ever going to move, now is the time before we get too old to make it happen. If something happens to me, her son would be shackled with helping her sell this place and get out there and I don't want that to happen.What made you decide to leave AR for AZ?

Not red-neckish enough for AR?

Go one more state NW and no state income tax.

-Don- Reno, NV

I can redneck anywhere. As long as I have hunting and fishing I'm quite happy.

Tulecreeper

Well-known member

@DonTom - Besides, we'll be in Buckeye so if you come toddling through there on one of your treks I'll buy you that steak.

Gary RV_Wizard

Site Team

Much the same with Florida, with a huge difference between the crowded & expensive South Florida that is well-known and the more rural north-central and panhandle regions. Or with New York, where most think the entire up-state region is like NYC & Long Island. And I'm sure others states could be cited as well.I don't understand ex-pats who move to 3rd world countries so they can live like kings. Most could live cheaper in MS which is only a 2nd world countryBut seriously, only the far west delta region from Natchez to Memphis gives MS the bad reputation.

DonTom

Well-known member

I think anywhere is cheaper in any state when you get far from the areas with all the jobs.Much the same with Florida, with a huge difference between the crowded & expensive South Florida

-Don- Reno, NV

Tulecreeper

Well-known member

California is the same. Most people I have met think it all looks like LA or San Francisco. I have to explain that most of it is rural woodland, or farmland. A large percentage of it looks like the below pics, which are from my deck here in W. AR.Much the same with Florida, with a huge difference between the crowded & expensive South Florida that is well-known and the more rural north-central and panhandle regions. Or with New York, where most think the entire up-state region is like NYC & Long Island. And I'm sure others states could be cited as well.

Attachments

DonTom

Well-known member

Yep. Many miles of nothing, especially as going north into the CA Redwood Trees.California is the same.

But still nothing like the countless miles of nothing I can find in Texas, when taking the smaller roads.

-Don- Reno, NV